Observatorio argentino 52: ¿Por qué Argentina es tan liberal con el litio?

Because it doesn’t make any money, that’s why

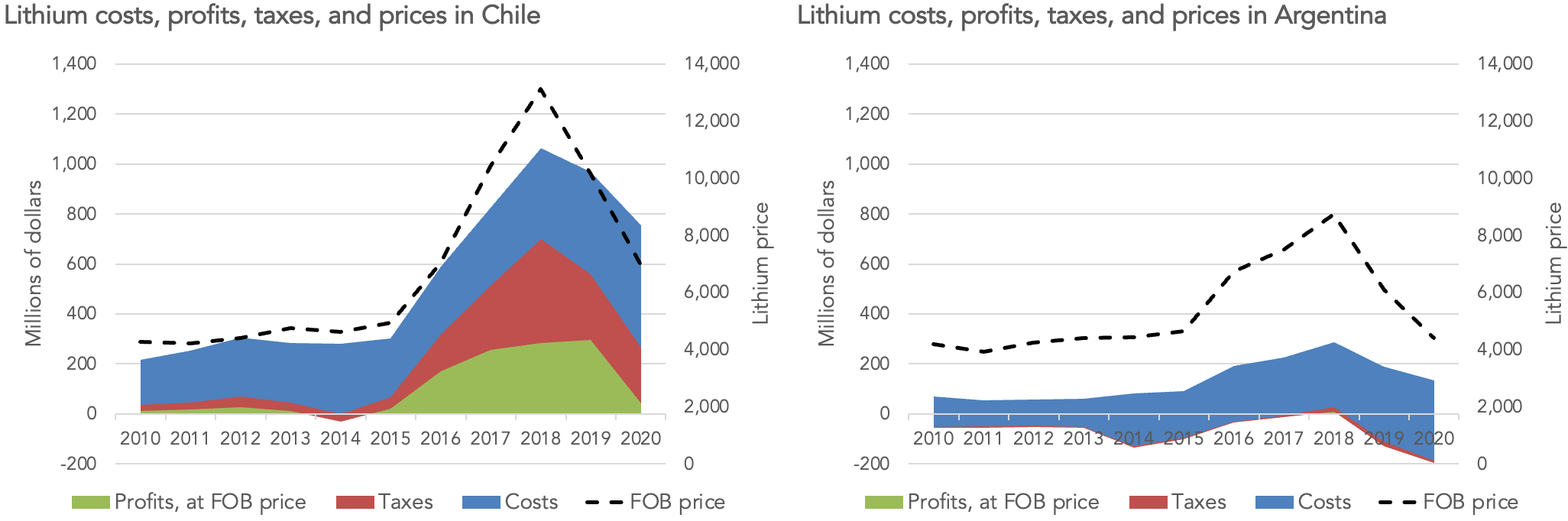

While Chile contemplates nationalizing its lithium industry, Argentina lets private industry rip. While Chile imposes very high taxes on the sector, Argentina barely taxes at all. This inversion of expectations has attracted international attention, with the Wilson Center praising Argentina and scolding Chile.

What explains the difference? It isn’t ideology. The Peronists in charge of Argentina have no compunction about nationalization: just ask YPF shareholders! Or anybody who had an Argentine pension account in 2008. It isn’t the constitution. It is true that the Argentine Confederation puts natural resources under provincial control. But the provinces with the lithium are all under Peronist control.1 In fact, the Peronists just won big in Salta despite the deteriorating national economy.

So why are the Argentines so ginger with the lithium mines? Simple. They don’t make any money. They likely will in the future, but not now.

Why don’t the Argentine mines make any money? First, they get less per unit of production. Why? CEPAL thinks the reason might be “transfer pricing,” in order to reduce profits booked in Argentina. I doubt that’s the reason … and even if it is, it doesn’t matter. It’s probably not that because the Argentine customs and tax authorities are well-aware that enterprises sell to related entities at lower prices. They don’t just accept that the taxable value is whatever the seller says. Second, lots of sales occur via long-term contracts and transport costs are high out of Salta and Catamarca. Third, lithium isn’t exported as a simple pure ore but rather in various different chemical forms; these all command different prices.

Second, they face higher production costs. On a unit basis, the CEPAL numbers imply that Argentine costs are around twice as high as Chilean. A lot of this is geographic. One of the easiest ways to produce lithium is to exact briny water from lithium-rich salt flats and let it evaporate: evaporation rates in Chile are almost 50% higher.2 Similarly, SQM’s Chilean brine deposits have the highest lithium content in South America.

Lower prices plus higher costs means less return. Chile is just luckier than Argentina.

None of this is to say that the Argentine industry will always be unprofitable! It’s ramping up fast, and the investors aren’t stupid. (Although it isn’t impossible to imagine a world where all the profits accrue to downstream battery manufacturers rather than upstream mines.) But it is to say that right now the reason that Argentina is being so nice to its lithium miners is simply that right now those miners aren’t making very much money, if any at all.

Article 35 of the Argentine constitution declares that the country has four official names: the Argentine Republic, the Argentine Nation, the Argentine Confederation, and the United Provinces of the Río de la Plata. For some nerdy reason, I find this very cool. When talking about Argentine federalism, I can call it a “confederation”!

Sadly, nobody ever says “Provincias Unidas” anymore.

Lithium producers in South America drill down 30 meters, pump out the brine, and then dump it into waterproofed solar evaporation ponds where they concentrate the lithium by evaporation. The Salar de Atacama in Chile evaporates at 3,200 mm/year compared to 2,300 mm/year in the Salar del Hombre Muerto, in Argentina.