How’s Milei doing?

Answer: better than hoped, if you don’t look at the recession

Mayor Ed Koch used to go around New York asking, “How’m I doing?” So, alright, how’s Argentina doing under President Milei?

First, inflation is down and falling. But still high: last month clocked in at 51%, which is still in the disastrous zone.

In order to bring inflation down further, the Milei administration is following the standard playbook. As we wrote last November, all successful inflation stabilization plans in Latin America have involved three things: (1) cutting the budget deficit; (2) targeting the exchange rate; and (3) cutting the current account deficit . How are all three going?

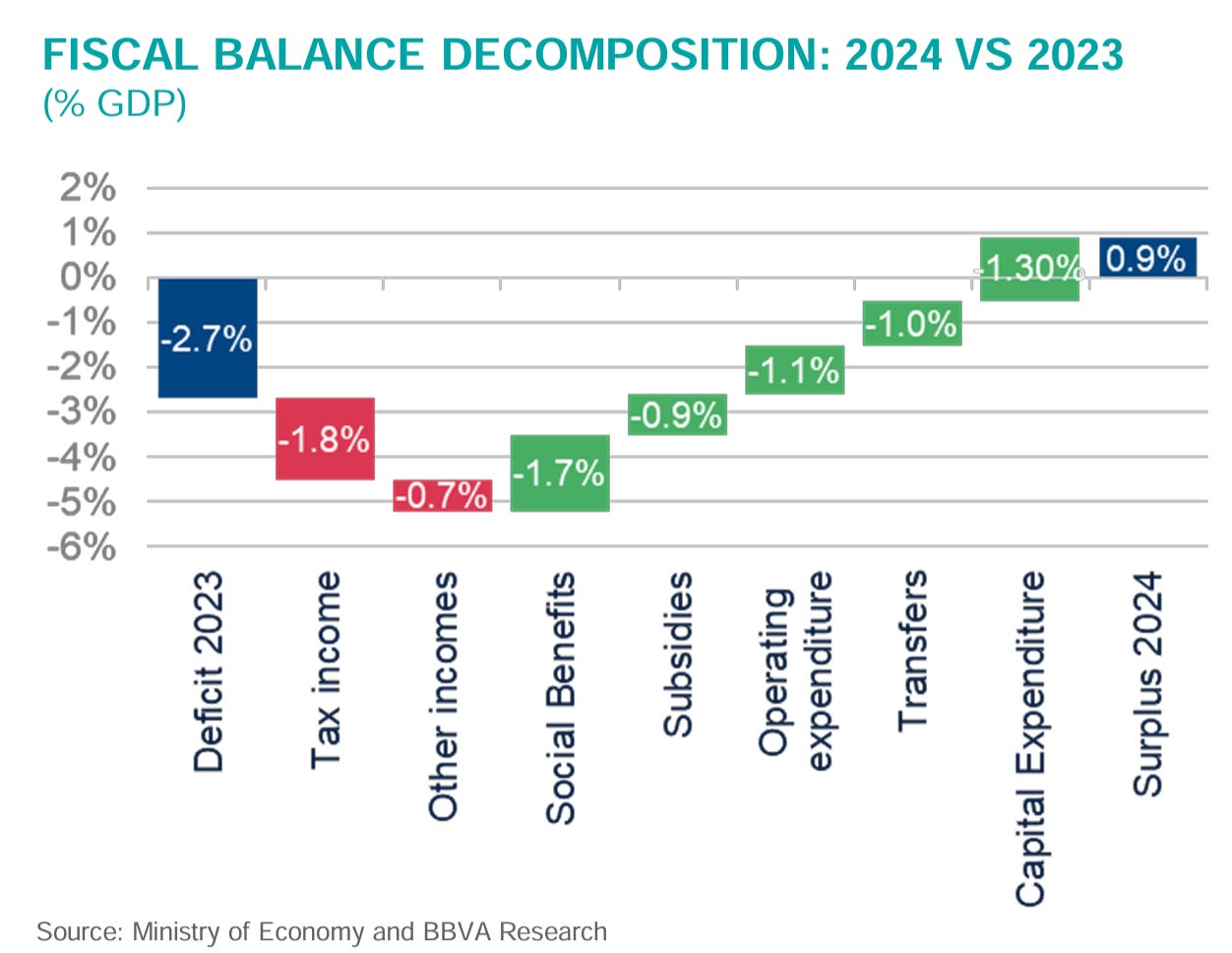

Budget surpluses

Last year, we didn’t think that the deficit could be zeroed out without some sort of debt renegotiation. But we also didn’t imagine that President Milei would manage to slash cash transfers by by 11% and crush capital spending by 73%. He did both. Total spending is down by a quarter in real terms.1

You can see from the above chart that the two biggest drivers have been cuts in pensions and capital expenditures. Let’s dive in a bit. Here are monthly real pensions over the last three presidential administrations, denoted by the color used by the ruling party:

The upper green line should be pretty shocking, or mighty impressive, depending on your politics. Average real pensions are down 30% on their 2020 level, although note the rebound after March. Antipoverty transfers have not been hit, which is why total spending on transfers is only down 11%.2

Meanwhile, capital spending is down 73% in real terms compared to September 2023. That’s going to bite the country in the ass pretty quickly, once the roads start developing potholes the size of New Jersey.3

Exchange rates

The Milei administration is holding the line on the exchange rate. It’s refused to liberalize, so big companies still have to buy and sell dollars at a government-mandated exchange rate. At the same time, monetary policy is being kept tight enough so that the blue market (aka, “black market”) exchange rate has been relatively stable. The below figure shows the blue market rate in, uh, blue, and the official rate in yellow. As with so much in Argentina, it has to be in a log scale.

The “real exchange rate” tries to capture whether the exchange rate is keeping up with relative changes in inflation. For example, if inflation in Argentina is lower than in the USA, but the peso doesn’t fall at the same rate, then things will get more expensive in Argentina measured in dollars and the real exchange rate will rise. Similarly, the peso falls faster than relative prices rise, then things will get cheaper in Argentina and the real exchange rate will fall.

The problem with using the exchange rate to control inflation becomes obvious: if inflation doesn’t fall fast enough, then the real exchange rate will rise, and all your exports will lose competitiveness.

So did that happen in Argentina? Well, it depends, but probably not.

The yellow line below represents the real exchange rate as measured by the Bank of International Settlements. It accounts for the fact that the euro and yuan exchange rates matter more to Argentine exporters than the dollar exchange rate. It also uses the official rate, which is the rate that most large exporters and importers have to use. It shows some gyrations around the time Milei took office, mostly due to the devaluation of the official exchange rate that you can see in the above figure and the short burst of hyperinflation.

But in general its a good result! Milei has managed to stabilize the official exchange rate — note the near straight line — without causing exporters too much pain. The real exchange rate is more-or-less where it was when he took office; heck, it’s more-or-less where it was in 2017.

But if you travel to Argentina, though, your wallet will tell you a different story. That’s the blue line below, which calculates the real exchange rate against the United States using the blue market dollar. It shows that Argentina is 50% more expensive than it was when Milei took office. That big a jump is something you will notice if you haven’t been there since last year, even if it’s not something that you should complain about.

Don’t complain because Argentina is still cheaper for Americans than it was back in 2017—and Argentina wasn’t particularly expensive back then. Here you can read what we wrote about Argentine prices in 2017, with no mention that the place felt expensive, because it wasn’t!

And you should note that the Libertarian president continues to maintain restrictive controls on capital and refuses to let businesses trade at free market prices.4

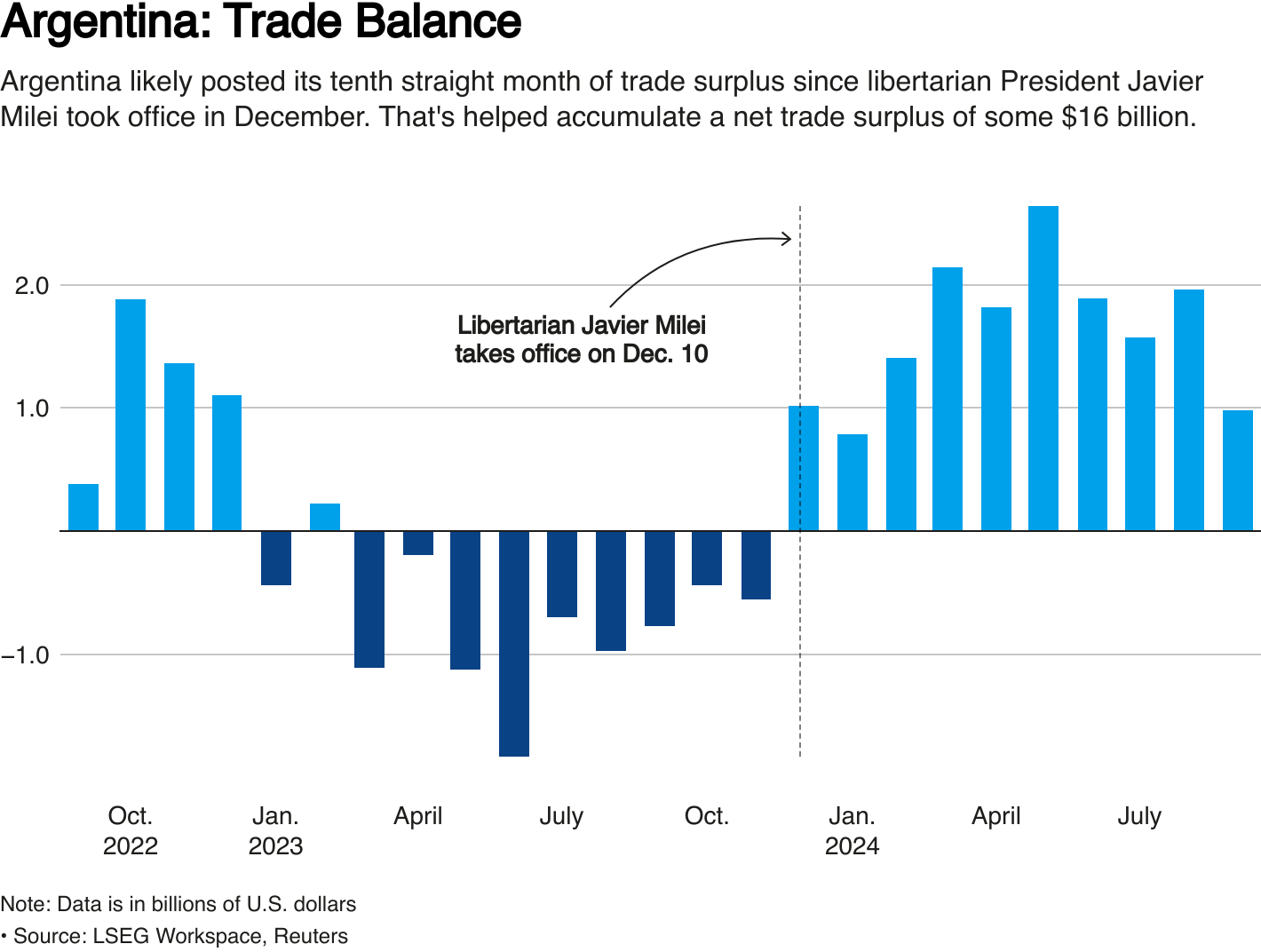

The trade balance

Exports have boomed. This is what you’d expect with the real exchange rate holding steady and — as we predicted — Argentina entered a new commodities boom.

Also, ironically, imports fell. Some of that was due to the recession, but a lot happened by dint of the Libertarian president raising a tax on imports from 7.5% to 17.5%.5 To be fair, the government just lowered it again and plans to phase out the tax completely. But that is a thing that happened.

Free trade? Free movement of capital? Pshhht. Even the Libertarians aren’t fully libertarian in a foxhole.

The real economy

Still terrible. Poverty has exploded. But the export boom is kicking in. Unemployment ticked down a bit in the second quarter, from 7.7% to 7.6%. And the fall in inflation has finally started to make life somewhat easier. Real wages are finally recovering, but only after a punishing fall:

The recent drop in real rents, which has done a lot to raise real wages, is due to the Milei government’s decision to abolish rent controls, which has freed up supply. (Now take on zoning laws, please.)

So he has stuck to his ideological guns in terms of slashing spending beyond what anyone expected and domestic deregulation.

Conclusion

If you hand-wave any the punishing recession and the human cost of the pension cuts, then things have gone better than anyone had any right to expect, and we were pretty optimistic. (Well, one of us was.) Argentina is set up for solid growth over the medium term, as the resource boom kicks in.

But there are still some political risks, and the capital budget cuts simply aren’t sustainable without wrecking the country. (More on that later, maybe, if there’s interest.) It wouldn’t be Argentina if all was sunny up ahead!

And you really have to look at that recession. Milei’s popularity is holding up, and it’s certainly possible that most other options would have been worse.

But it’s a massive human tragedy.

The administration has finally gotten Congress to raise taxes, but the brutal recession means that real revenue was down 8.1% for the year through September. The bill also cut taxes dramatically for large new investment projects.

Total spending on non-pension transfers went up; spending per person went down, what with the increase in poverty and unemployment. This might be worth a deeper dive, if there’s interest.

Since he is a founding member of the Liberty Party, I capitalize “Libertarian.” I do not do that when referring just to the ideology.

Milei’s hike in “impuesto PAIS,” short for (groan) the “impuesto Para una Argentina Inclusiva y Solidaria” cushioned the blow of falling tax revenues. The hike went through by decree, Congress not involved. The tax also falls on purchases of dollars for any purpose.