Argentina: Good Land, Bad Debts, Ugly Incentives

Another commodity boom looks set to bail out the country (and American aid doesn't hurt) but the government looks to turn it into a nail-biting rollercoaster ride

First, go read Boz’s scenarios for the 2027 presidential election in Argentina.

You’re back? Great! He divides the possibilities into three verticals: the economy crashes, things muddle along, or the economy booms. He then asks himself, what needs to be true under each of these verticals for Milei to win re-election or for Milei to hand over the Casa Rosada to somebody else. It’s quite well done.

Here, I want to discuss the probabilities of the three scenarios. TLDR:

Argentina is starting a resource boom and its trade surplus will rise sharply. Good!

Chinese and American swap lines (plus other less obvious forms of American assistance) provide insurance. Also good.

Therefore Argentina can probably meet its rather large obligations …

But reserve accumulation is not guaranteed and mismanaging the exchange rate raises the risk. That’s bad.

Milei seems to really want to avoid letting the peso float, which is pretty egregious mismanagement of the exchange rate. Heck, devaluation is needed if he still wants to dollarize. And a devaluation could let the central bank ease up on interest rates. The only way defending the peso makes economic sense is fear of inflation, but that’s probably overdone. That’s also pretty bad.

Unfortunately, mismanaging the exchange rate makes political sense.

That’s ugly.

Since I am a huge fan of Clint Eastwood, let me use an often misinterpreted metaphor and call the following sections the Good, the Bad, and the Ugly.1

The Good

Argentina really is the lucky country. If you were in a spaceship and you found the uninhabited Earth, it’s where you would want to plant your colony. That plot of land has everything, in a geography that makes it all relatively easy to get.

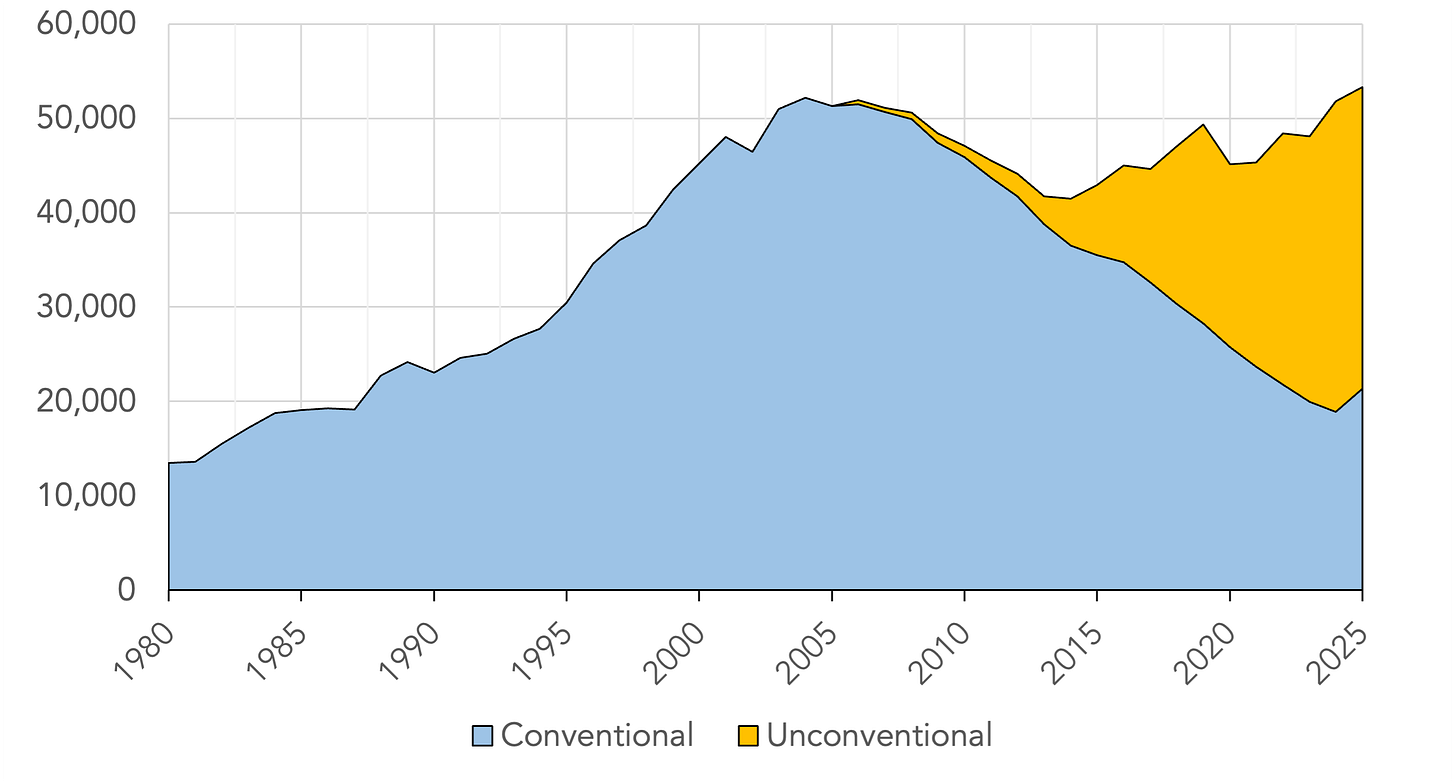

And so Argentina’s geography looks set to bail it out. Mining exports rose 33% over the course of 2025 and output is scheduled to rise a further 20% in 2026. Hydrocarbon output rose as well. This year, oil production is expected to rise by 9.7% and natural gas by 5.3% — oil production is already outpacing that and gas is only a little below expectations. The government projects that gas production will stagnate and oil production grow by 25% between now and 2029 — but both projections are only from existing fields. Argentina is bringing new ones into play every year.

Even taking account that the hydrocarbon projections are unreasonably low, the Argentine central bank (BCRA) expects hydrocarbon exports to increase from $10 billion in 2024 to $37 billion by 2030 and mining exports from $6 billion to $16 billion. That alone would increase GDP growth in 2025-30 by five percentage points. The IMF’s projections are similar, expecting net energy exports to grow from about $3 billion last year to more than $25 billion by 2030.

The IMF also projects that mining exports will almost quintuple in the same period, from around $8 billion to $38 billion — that would add another four points of growth between now and 2030. The BCRA is more conservative, expecting growth around $12½ billion, which would add “only” another two points to growth.

In 2016, KPMG calculated that mining had a multiplier effect around 1.7 — that is to say, a dollar of mining exports induced about 70¢ in additional economic activity. Estimates for hydrocarbons, however, are all over the map (ranging from 0.5 to 3.0) so let’s assume that the mining multiplier is 1.7 but there is no hydrocarbon multiplier (i.e., its value is one). That would translate into annual growth rate over the next five years of somewhere between 1.7% and 2.5% more than it otherwise would have been.

That’s a lot! I’ll smile for you, Argentina.